If you work in a jurisdiction that does NOT tax non-residents, your employer is only required to withhold for those individuals who live in that jurisdiction. Whose earned income tax will be withheld by their employer?Īny individual working in a jurisdiction that levies the tax on residents and non-residents will have the tax withheld by their employer. It is still required that our Registration Form be answered by all residents. No, the tax withheld by your employer will be remitted to your resident taxing jurisdiction.

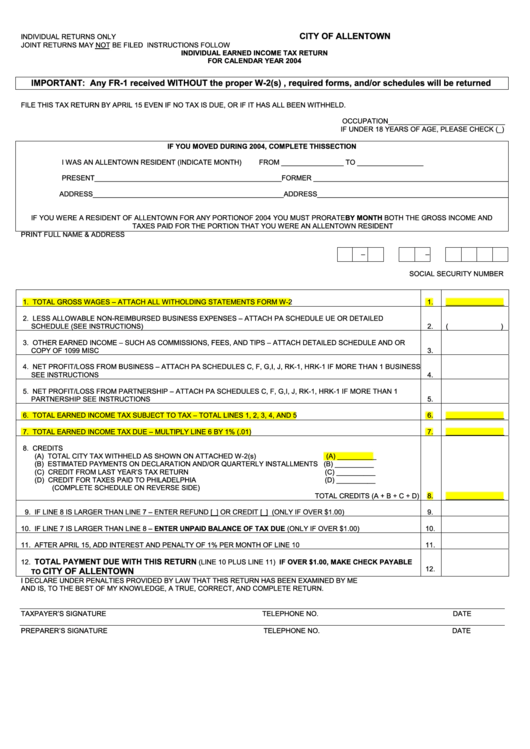

If the tax is withheld in another community where I work, do I also pay the district in which I live? In addition, net profits of corporations are exempt under state law. Also exempt are payments for third party sick or disability benefits, old age benefits, retirement pay, pensions - including social security payments, public assistance or unemployment compensation payments made by any governmental agency, and any wages or compensation paid by the United States for active service in the forces of the United States including bonuses or additional compensation for such service. Unearned income such as dividends, interest, income from trusts, bonds, insurance and stocks is exempt. What income is specifically exempt from the earned income tax? In addition, those who conduct businesses, professions and other activities for profit must pay tax on the net profit derived from their operation after deductions have been made of all costs and expenses incurred in conducting said business. Typically, individuals who receive "earned income," including salaries, wages, commissions, bonuses, incentive payments, fees, tips and/or other compensation for services rendered, whether in cash or property, are subject to the tax. The Earned Income Tax, commonly called a "Wage Tax," is usually a tax of one percent (1%) on gross wages and/or net profits from a business or profession. Berkheimer (Mercantile/Business Priviledge)

0 kommentar(er)

0 kommentar(er)